alphalist 7.3|Alphalist 1604CF Schedule 7.3 For The Y : Manila Alphalist Data Entry and Validation Module Version 7.3 (New) To download the Alphalist Data Entry & Validation Module Version 7.3 just click on the following: ZIP Polígono de Sabón, Arteixo, A CORUÑA (ESPAÑA) Inscrita en el Registro Mercantil de A Coruña en el Tomo 2438 del Archivo, Sección General, a los folios 91 y siguientes, hoja C-2141. CIF: A .

PH0 · What Is Annualized Withholding Tax (Alphalist)?

PH1 · What Is Annualized Withholding Tax (Alphalist)?

PH2 · Search

PH3 · Revenue

PH4 · Friendly Reminder: Have you submitted your BIR Alphalist and 1604CF

PH5 · Friendly Reminder: Have you submitted your BIR

PH6 · Downloadables

PH7 · BIR RMC No. 61

PH8 · Availability of new Alphalist Data Entry and

PH9 · Alphalist 1604CF Schedule 7.3 For The Y

PENTANA SOLUTIONS PTY LTD: ABN status: Active from 10 Mar 2000 Entity type: Australian Private Company: Goods & Services Tax (GST): . PENTANA SOLUTIONS 26 Jun 2009 REYNA RENTALS 26 Jun 2009 REYNOLDS DMS AND REYNOLDS INFO SYSTEMS 26 Jun 2009 REYREY 26 Jun 2009 .

alphalist 7.3*******Alphalist Data Entry and Validation Module Version 7.3 (New) To download the Alphalist Data Entry & Validation Module Version 7.3 just click on the following: ZIP

Learn how to register for a taxpayer identification number (TIN), update your .

Alphalist Data Entry and Validation Module Version 7.3. Semestral List of Regular Suppliers (SRS) Validation Module. eRegistry System Version 1.0. Relief Version 2.3. .. the availability of the Alphalist Data Entry and Validation Module (Version 7.3) and its updated File Structures and Standard File Naming Convention Digest | Full Text | .

The new Alphalist Data Entry and Validation Module (Version 7.0) shall be used for the following alphalist attachments: Monthly alphalist of payees for BIR Form Nos. 1600-VT and 1600-PT; .alphalist 7.3 Alphalist 1604CF Schedule 7.3 For The Y The new Alphalist Data Entry and Validation Module (Version 7.0) shall be used for the following alphalist attachments: Monthly alphalist of payees for BIR Form Nos. 1600-VT and 1600-PT; .

Revenue Memorandum Circular No. 61-2024 Notifies the availability of the Alphalist Data Entry and Validation Module (Version 7.3) and its updated File Structures and Standard .

Revenue Memorandum Circular No. 7-2021 Announces the availability of the Alphalist Data Entry and Validation Module (Version 7.0) and its updated file.

The Bureau of Internal Revenue (BIR) issued Revenue Memorandum Circular No. 61-2024 which states the UPDATED version of the Alpha list Data Entry .ALPHALIST 1604CF SCHEDULE 7.3 FOR THE Y-2019 - Free download as Excel Spreadsheet (.xls / .xlsx), PDF File (.pdf), Text File (.txt) or read online for free.Alphalist 1604CF Schedule 7.3 For The YPayrollHero helps complete AlphaList requirements for you. Compute annualized withholding tax easily with our tax examples and Alphalist computation samples. Schedule 7.2: Alphalist of employees whose compensation income are exempt from withholding tax but subject to tax income (reported under BIR Form 2316) Schedule 7.3: Alphalist of . RMC No. 61 – 2024: Availability of the Alphalist Data Entry and Validation Module (Version 7.3) and its Updated File Structures and Standard File Naming Convention The Bureau of Internal Revenue (BIR) issued Revenue Memorandum Circular No. 61-2024 which states the UPDATED version of the Alpha list Data Entry and Validation Module .

1. Secure a signed copy of the form. 2. Upon computation of your income tax liability, deduct the total amount supported by your BIR Forms 2307 to get your income tax payable. 3. Attach scanned copies of all your BIR Forms 2307 in your Quarterly Income Tax Returns and Annual Income Tax Returns (BIR Forms 1701 or 1702).

Hi Taxpayers! Here's a short video on how to download and install the Alphalist Data Entry and Validation Module. Hi Guys! Below are the links mentioned in the video:Where to download Alphalist 7.0? https://www.bir.gov.ph/index.php/downloadables.htmlRMC 7 .

Announces the availability of the Alphalist Data Entry and Validation Module (Version 7.3) and its updated File Structures and Standard File Naming Convention Digest | Full Text | Annexes: May 13, 2024: RMC No. 62-2024: Announces the availability of the "Taxpayer Classification Inquiry" functionality in the Online Registration and Update System

The revised format of alphalist now includes details on the utilization of the 5% tax credit under the Personal Equity and Retirement Account (PERA) Act of 2008. The alphalist of employees shall serve as an attachment to the BIR Form No. 1604-C due on or before January 31 of the year following the calendar year the compensation and other .

RMC No. 131-2022: Offline eBIRForms Package Version 7.9.3. On September 28, 2022, the BIR issues the RMC No 131-2022 to announce the availability of Offline eBIRForms Package Version 7.9.3 which can be downloaded from the following sites: The new Offline eBIRForms Package has the following modifications:By: Garry S. Pagaspas. In another effort to enhance tax compliance in the Philippines, the Bureau of Internal Revenue (BIR) issued Revenue Regulations No. 1-2014 dated December 17, 2013 on submission of alphabetical list or alphalist of employees and list of payees on income payments subject to withholding taxes in the Philippines.. Amendment to .

[tutorial] alphalist data entry: import data records old version to new version/ reindex all [complete video]

This Tax Alert is issued to inform all concerned on the availability of the new Alphalist Data Entry and Validation Module (Version 7.0). The new Alphalist Data Entry and Validation Module (Version 7.0) shall be used for the following alphalist attachments: Annual alphalist of employees/payees for BIR Form No. 1604C, 1604E and 1604F. Taxpayers .alphalist 7.3Pursuant to RMC No. 25-2024, the deadline for submission of alphalist shall be thirty (30) days from the date of posting of a tax advisory on the BIR website announcing the availability of the updated version of the Alphalist Data Entry and Validation Module. In this regard, on February 16, 2023, the Bureau of Internal Revenue (BIR) posted a . Submission of 2023 Alphalist of Employees extended until February 28, 2024. (Revenue Memorandum Circular No. 16-2024, January 26, 2024) This Tax Alert is issued to inform all the concerned of the extension of the deadline of submission of the alphalist of employees as attachment to BIR Form 1604-C for the taxable year 2023 .

#TaxTrainingByElsaMCaneteGuide on How to Download, Data Entry, Validate and Submit in the New BIR Alphalist version 7.0.

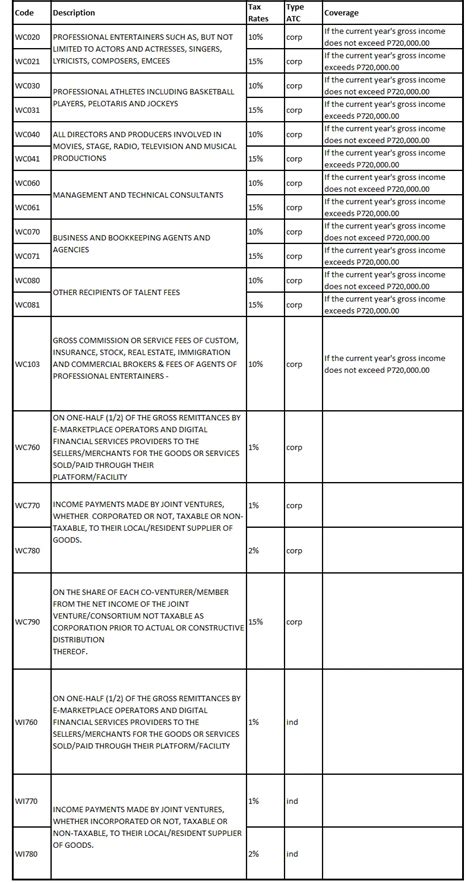

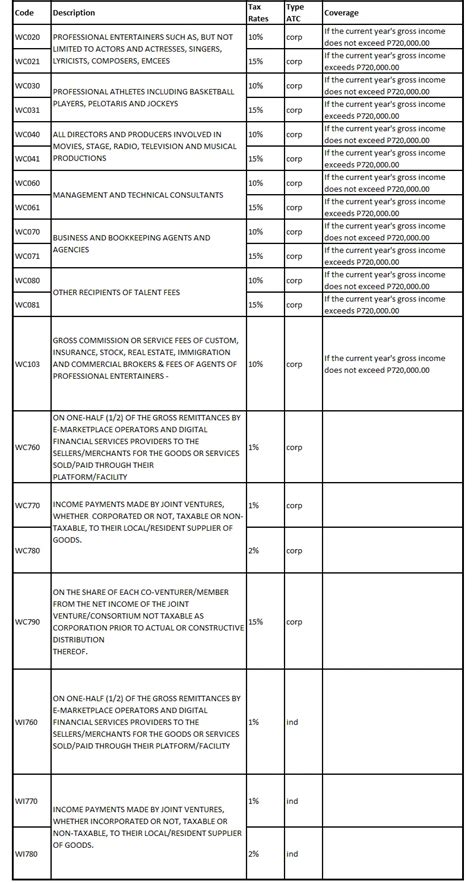

𝐇𝐨𝐰 𝐭𝐨 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 & 𝐈𝐧𝐬𝐭𝐚𝐥𝐥 𝐁𝐈𝐑 𝐀𝐥𝐩𝐡𝐚𝐥𝐢𝐬𝐭 𝐃𝐚𝐭𝐚 𝐄𝐧𝐭𝐫𝐲 𝐚𝐧𝐝 .1. 2024 Revenue Memorandum Circulars (Revenue Issuances) . the availability of the Alphalist Data Entry and Validation Module (Version 7.3) and its updated File Structures and Standard File Naming Convention Digest | Full Text | Annexes May 13, 2024 RMC . 2. Processing of Tax Treaty Relief Applications (TTRA) and Request for Confirmation .The Alphalist contains 3 documents 1- Alphabetical list of employees from whom taxes were withheld (BIR Format) : https://goo.gl/3Hvgu. The report divides the information into the following categories: A. Employees with no previous employers during the financial year; B. Employees with previous employers during the financial yearMonthly Alphalist of Payees (MAP) –BIR Form No. 1600-VT and 1600 – PT ; Quarterly Alphalist of Payees (QAP) – BIR Form No. 1601EQ ; QAP – BIR Form No. 1601FQ ; QAP – BIR Form No. 1621 ; Annual Alphalist of Payees – BIR Form No. 1604-C ; Here is a sample for the revised file structure of one of the tax documents (MAP): HEADER

Alphalist of Payees Subjected to Final Withholding Tax. 7. Alphalist of Minimum Wage Earners Note: All background information must be properly filled up. - All returns filed by an accredited tax agent on behalf of a taxpayer shall bear the following information: A. For CPA's and others (individual pratitioners and members of GPP's);

4. Parking Slot, Parking Area and Loading/Unloading Space Requirements a. The parking slot, parking area and loading/unloading space requirements listed hereafter are generally the minimum off-streeU;~m on-site requirements for specific uses/occupancies for buildings/structures, Le., all to be located outside of the road right-of-way (RROW). b.

alphalist 7.3|Alphalist 1604CF Schedule 7.3 For The Y